AMM Weekend

Last week's sales demonstrated there's a very wide gap between the $90m art works and the rest of the market.

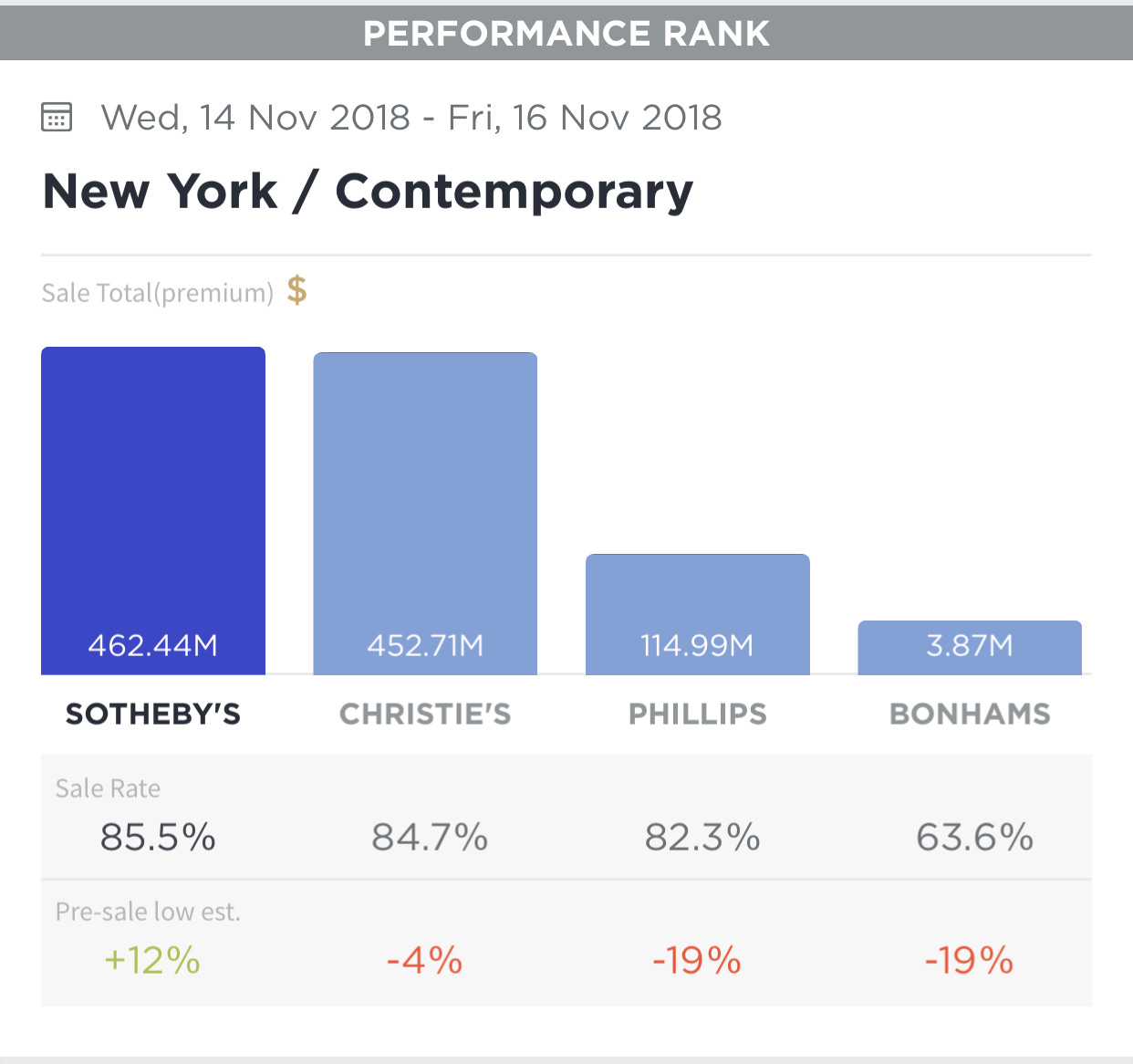

Live Auction Art’s Chart of New York Contemporary Sales

The Hidden Masterpiece Market

If this last week’s sales are any indication, the art market has made a decisive shift. Some would like to see this as a shift toward valuing historically under-represented populations. In this view, the market has come to recognize the importance and value of previously…

Keep reading with a 7-day free trial

Subscribe to Artelligence to keep reading this post and get 7 days of free access to the full post archives.